Drawing on a diversified pool of European and international banks, Gunvor Group has successfully closed an oversubscribed borrowing base credit facility to support operations at the Independent Belgian Refinery (IBR). The facility launched at USD $500 million and closed oversubscribed at USD $625 million.

“Confidence in Gunvor’s business plan for its refining operations is very strong, with about 45 percent of IBR’s facility consisting of new funding beyond standing allocations from our banking partners,” a Gunvor spokesperson said. “Gunvor’s move to diversify its operations to become a truly integrated trading house has clear support.”

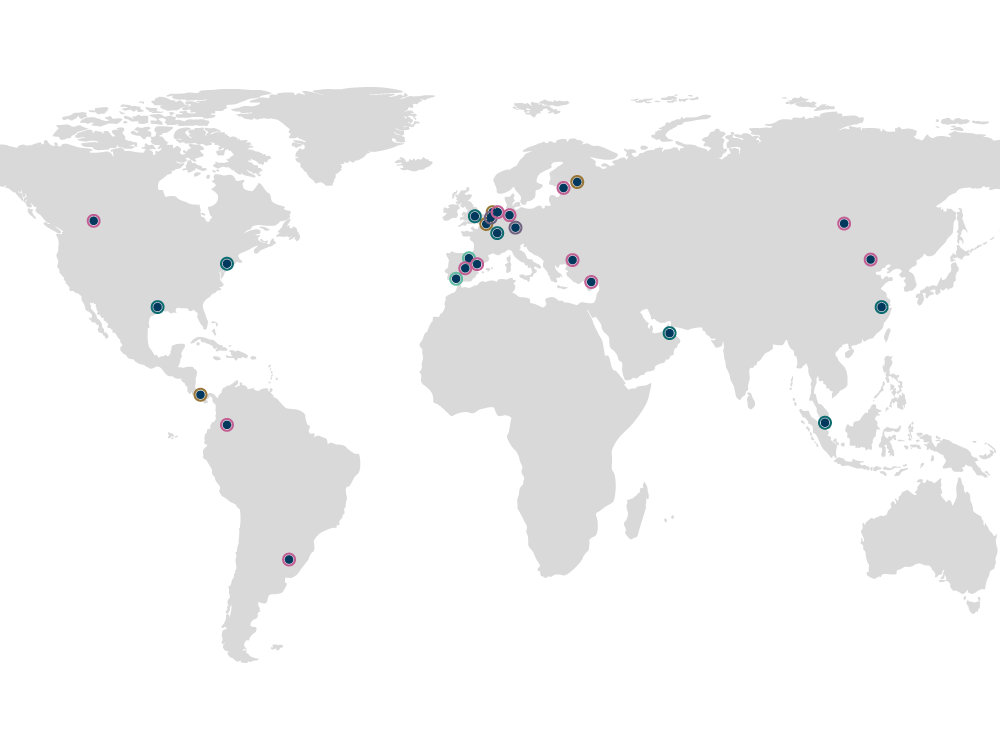

ING and Rabobank are the two Mandated Lead Arrangers of the facility, of which a full quarter of the participation came from non-European markets. The facility will be used to finance the purchase of crude oilCrude oil refers to unrefined petroleum that is found with the Earth’s crust. Read more and feedstock for the refinery, i.e., blending products, storage and processing at the refinery’s premises, and carrying of receivables.

Completion of the IBR syndication continues a strong year of support for Gunvor, which has announced:

- Successful completion by Gunvor Singapore Pte Ltd of an oversubscribed USD $635 million syndicated RCF, which drew considerable new support from local banks in the Asia-Pacific Region;

- Launch of a USD $800 million revolving credit facility for general working capital;

- Successful completion of 5-year USD $250 million Secured Acquisition facility to support the acquisition of Gunvor’s stake in Signal Peak.

Gunvor’s team is already working on a syndication to support operations at the recently acquired refinery in Ingolstadt.