Gunvor Singapore Pte Ltd today signed a USD635 Million syndicated revolving credit facility (RCF), which drew considerable new support from local banks in the Asia-Pacific Region, affirming the Company’s decision to create a stand-alone syndication. The Facility was launched at USD470 Million and closed oversubscribed by 35 percent, a result that demonstrates clear support for the Company’s long-term growth strategy in Asia Pacific.

“By attracting such considerable confidence from local banks in the Asia-Pacific region, our Singapore regional hub Gunvor Singapore Pte Ltd has built a truly regional portfolio of support for our growth strategy,“ said Torbjörn Törnqvist, CEO of Gunvor Group.

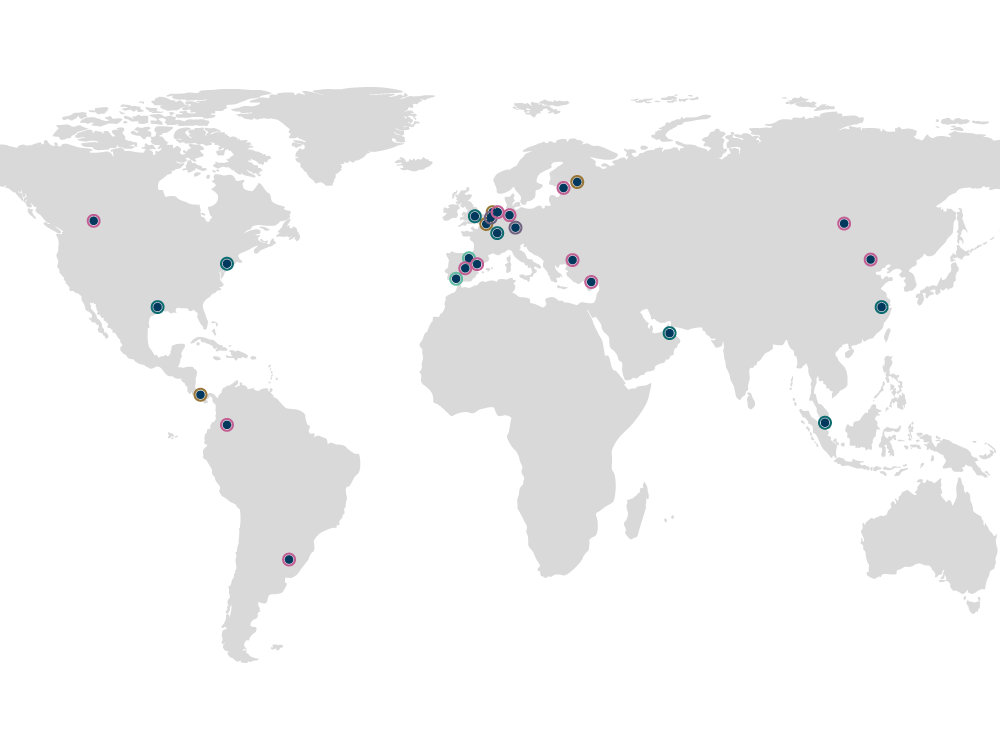

A total of 28 banks (15 Asian, 8 European, 5 Middle Eastern) committed during the general syndication. The Company mandated China Development Bank, Australia and New Zealand Banking Group Limited, Arab Petroleum Investments Corporation (APICORP), DBS Bank, First Gulf Bank P.J.S.C, Singapore Branch, ING Bank N.V., Singapore Branch, National Australia Bank, Singapore Branch, Société Générale Corporate & Investment Banking and Sumitomo Mitsui Banking Corporation as Bookrunning Mandated Lead Arrangers for this transaction. Proceeds of the RCF will be used to refinance existing debt and to finance general and working capital requirements of the Company. The Facility has a one-year tenor.

Banks participating in the RCF include: United Overseas Bank Limited, Bank of Baroda, Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (trading as Rabobank International), Singapore Branch, Crédit Agricole Corporate and Investment Bank, Singapore Branch, ABN AMRO Bank N.V., Bank of Taiwan, Singapore Branch, Chinatrust Commercial Bank Co., Ltd, Singapore Branch, Emirates NBD PJSC, First Commercial Bank, Singapore Branch, The Mauritius Commercial Bank Limited, Natixis, Qatar National Bank SAQ, Singapore Branch, Raiffeisen Bank International AG, Singapore Branch, The Royal Bank of Scotland plc, The Bank of East Asia, Limited, Singapore Branch, Chang Hwa Commercial Bank, Ltd., Singapore Branch, Land Bank of Taiwan, Offshore Banking Branch, Mega International Commercial Bank Co., Ltd., Singapore Branch, PT Bank Mandiri (Persero) TBK, Singapore Branch. Sumitomo Mitsui Banking Corporation, Singapore Branch is the Facility Agent for the transaction.