Moving

Energy

Forward

Gunvor creates logistics solutions that safely and efficiently move commodities from where they are sourced and stored to where they are demanded most.

Moving energy from where it is sourced and stored to where it is demanded most

-

Employees

2,000

-

Liquids

3.2 million b/d

-

Revenue

US $136 billion

-

Volumes

232 million MT

Employees

Liquids

Revenue

Volumes

BUDAPEST – Gunvor, one of the world’s leading independent commodities trading companies, and New Energy (member of the NE-TECH Group), a Budapest-based technology company specializing in the advanced chemical recycling of end-of-life tires, are pleased to announce the signing of a strategic collaboration agreement aimed at jointly advancing the transition toward a circular economy.

According to the terms of the agreement, New Energy will supply Gunvor with pyrolysis oil produced from waste tires at its industrial-scale recycling facility located in Dunaharaszti, Hungary. This collaboration will include supplies from additional NE-TECH facilities under development in Karcag, Hungary, as well as in Western Europe and other regions outside the European Union.

The pyrolysis oil will be used as a feedstock for refineries, replacing conventional fossil-based raw materials. The use of chemically recycled oil reduces carbon emissions and aligns with key principles of circular economy models by enabling material reuse and waste minimization.

Ricardo Cordeiro de Sousa, Circular Naphtha and Pyrolysis Oil trader at Gunvor, commented: “On top of conventional products, Gunvor is committed to increasing its support for the ‘circular economy’ and the Energy Transition. NE-TECH has a unique technology that is working on full industrial scale operating 24/7, and together we can offer both economic advantages and environmental benefits. We look forward to working with New Energy and sourcing products from its current and new facilities in Europe.”

Viktor Varadi, CEO of NE-TECH Group, added: “This partnership underlines our successful development and optimization of our processes to maximize economic efficiency of our plant and technology. We are proud that we achieved this level, where we qualify our products to the high standards of Gunvor, and partner with one of the world’s leading independent commodities trading companies This collaboration will result in the production of more environment friendly products made by the petrochemical industry.”

The partnership between Gunvor and NE-TECH Group represents a meaningful step toward scalable, commercially viable circular solutions in the energy and chemical sectors.

About NE-TECH Group

NE-TECH Group is an innovative technology group. Its group companies are specialized in the development and commercialization of solutions related to circular economy. NE-TECH’s main mission is to turn formerly untreatable polymer based and organic waste streams into useful raw materials for the petrochemical industry, thus addressing the unsustainable extraction of natural resources in an economically viable manner. NE-TECH has developed and commercialized a proprietary technology that can turn waste tires back to secondary raw materials to support circular economy strategies of its partners and customers. It also has two decades of operational experience in running a pyrolysis plant by group member New Energy. Further information about NE-TECH at www.ne-tech.eu

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy and bulk materials from where they are sourced and stored to where they are demanded most. Gunvor has strategic investments in industrial infrastructure—refineries, pipelines, storage and terminals—that complement our core trading activity and generate sustainable value across the global supply chain for our customers. Further information can be found at www.gunvorgroup.com.

Agreement Propels Texas LNG Toward a Final Investment Decision

HOUSTON – Texas LNG Brownsville LLC, a four million tonnes per annum (“MTPA”) liquefied natural gas export terminal to be constructed in the Port of Brownsville, Texas, has signed a definitive 20-year Sales and Purchase Agreement with Gunvor Singapore Pte Ltd for 0.5 MTPA of LNG from Texas LNG on a Free on Board basis. The agreement converts a previous non-binding Heads of Agreement between the two companies. Texas LNG Brownsville LLC is a subsidiary of Glenfarne Energy Transition, LLC, and Gunvor Singapore Pte Ltd is a subsidiary of Gunvor Group.

“Texas LNG is moving rapidly towards a targeted year-end Final Investment Decision,” said Glenfarne Chief Executive Officer and Founder Brendan Duval. “Our agreement with Gunvor continues our progressing of successfully completed commercial contracts, sufficient for FID, for Texas LNG. Together with the advanced state of project financing and completion of the FERC process last month, this project is poised to unlock the superior benefits of clean, reliable U.S. LNG for Gunvor and our other partners.”

“As one of the foundation customers of Texas LNG, we are pleased to complete this agreement and open up new sources of U.S. LNG to meet the growing demand for secure energy in overseas markets,” said Kalpesh Patel, Co-Head of LNG Trading of Gunvor.

The majority of Texas LNG’s offtake volume will be sold under long-term binding agreements. Texas LNG is in the process of converting HOAs with Macquarie and another highly experienced, investment-grade global LNG player into definitive agreements. Kiewit is leading the engineering, procurement, and construction of Texas LNG under a lump-sum turnkey structure.

About Texas LNG

Texas LNG is an LNG export facility to be constructed in the Port of Brownsville, Texas and a subsidiary of global energy transition leader Glenfarne Energy Transition, LLC. Texas LNG is led by an experienced team committed to creating one of the cleanest, lowest emitting LNG export facilities in the world through electric motor drives. Additional information about Texas LNG may be found on its website at www.texaslng.com.

About Glenfarne

Glenfarne Group is a privately held developer, owner, and operator of energy infrastructure assets based in New York, New York and Houston, Texas, with offices in Anchorage, Alaska; Panama City, Panama; Santiago, Chile; Bogota, Colombia; Barcelona, Spain; and Seoul, South Korea. Through its subsidiaries, Glenfarne owns and operates over 60 energy infrastructure assets through three core businesses: Global LNG Solutions, Grid Stability, and Renewables. The company’s seasoned executives, asset managers, and operators develop, acquire, manage, and operate energy infrastructure assets throughout North and South America. For more information, please visit www.glenfarne.com.

About Gunvor Group

Gunvor is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy from where it is sourced and stored to where it is demanded most. Gunvor has strategic investments in industrial infrastructure — refineries, pipelines, storage and terminals — that complement our core trading activity and generate sustainable value across the global supply chain for our customers. The company, which in 2024 generated U.S. $136 billion in revenue on 232 million MT of volumes, is the leading independent global trader of liquefied natural gas (LNG).

Strategic alignment would secure critical feedstock, product offtake, and sustainability value as Genesis Fertilizers advances toward a low-carbon production future in Western Canada

SASKATOON – Genesis Fertilizers is pleased to announce the signing of a commercial Letter of Intent (LOI) with Gunvor USA LLC, one of the world’s largest independent commodities trading houses, to jointly pursue three key agreements for Genesis Fertilizers’ proposed nitrogen fertilizer production facility at Belle Plaine, SK (the Facility): a natural gas supply agreement, a diesel exhaust fluid (DEF) offtake agreement, and a carbon credits offtake agreement. This collaboration further advances Genesis Fertilizers’ commitment to building a modern, low-carbon fertilizer facility that provides value across the supply chain—from global traders to Western Canadian farmers.

The three agreements currently in discussion to be finalized are intended to govern long-term strategic collaboration, including natural gas supply to the Facility, full offtake of the Facility’s DEF product to Gunvor, and Gunvor’s purchase of up to 100% of carbon credits generated through the Facility’s carbon capture and sequestration technologies.

“This is a defining step in securing critical commercial components for the Genesis Fertilizers project,” said Derek Penner, President and CEO of Genesis Fertilizers. “Gunvor brings exceptional market insight and global scale, and their participation is a strong validation of our integrated, sustainability-driven model.”

Key Elements of the Proposed Agreements:

Natural Gas Supply Agreement:

- Secures natural gas feedstock from Gunvor for the Facility, enabling year-round production at scale.

- Encompasses approximately 23 million GJ per year from 2029, creating incremental demand for Canada natural resources and displacing imports.

- Ensures flexible, firm delivery supported by long-term transport arrangements.

Diesel Exhaust Fluid (DEF) Offtake Agreement:

- Gunvor to purchase 100% of the DEF volume produced by the Genesis facility annually (approx. 215,000 MT).

- DEF will be produced to international purity standards and delivered FOB via rail.

Carbon Credit Offtake Agreement:

- Gunvor to purchase up to 100% of carbon credits generated from Genesis’s carbon capture and sequestration process.

- Represents approximately 682,000 MT per year of CO₂ credits.

- Designed to align with emerging regulatory regime and carbon markets.

Gunvor highlighted the alignment in values, stating: “Genesis Fertilizers represents the future of sustainable agri-input production. Our team is excited to collaborate on this transformational project and bring forward a supply chain anchored in reliability, transparency, and emissions reduction.”

Enabling a Sustainable Ag Future

The Belle Plaine facility is being designed as one of the most modern and sustainable nitrogen fertilizer production sites in North America. Featuring an integrated carbon capture system and built to optimize product and energy efficiency, the project is expected to play a key role in supporting Canadian agriculture’s low-emission future.

The Letter of Intent signed with Gunvor is a critical milestone as Genesis Fertilizers moves toward Final Investment Decision (FID), targeted in early 2026.

About Genesis Fertilizers

Genesis Fertilizers is proposing to finance, design and construct a new, highly efficient nitrogen fertilizer production and distribution system that serves today’s modern farmer. This will be comprised of a central production facility constructed near low-cost raw materials serving a Western Canadian network of strategically located farmer-centric distribution centres. Genesis Fertilizers’ is a privately held limited partnership, and its securities do not trade on any exchange.

SINGAPORE — AMIGO LNG S.A. de C.V. (“AMIGO LNG”), the Mexican joint venture of Texas-based Epcilon LNG LLC and Singapore-based LNG Alliance, today announced the signing of a definitive Long-Term Sale and Purchase Agreement (SPA) with Gunvor Singapore Pte Ltd (“Gunvor”), one of the world’s leading independent commodity trading houses.

Under the agreement, Gunvor will purchase 0.85 million tonnes per annum (MTPA) of LNG for 20 years, with deliveries commencing upon the start of commercial operations of AMIGO LNG’s first liquefaction train, scheduled for latter half of 2028.

This long-term commitment marks a major milestone for AMIGO LNG, reinforcing its position as Mexico’s first large-scale LNG export terminal on the west coast of Americas. The Guaymas-based facility will leverage its strategic location and proximity to the prolific U.S. Permian Basin to deliver competitive LNG supplies to customers in Asia and Latin America.

“Gunvor is committed to securing long-term LNG supplies to meet the evolving energy needs of our customers worldwide. Partnering with AMIGO LNG aligns with our strategy of diversifying supply sources and supporting the global transition toward cleaner energy,” said Kalpesh Patel, Co-Head of LNG Trading of Gunvor.

“We are delighted to welcome Gunvor as one of our key foundation offtakers. This agreement underscores the confidence global energy players place in AMIGO LNG’s ability to deliver reliable, flexible, and competitive LNG to international markets,” said Dr. Muthu Chezhian, CEO of LNG Alliance.

In addition to strengthening global LNG supply chains, the AMIGO LNG project serves as a bridge for U.S.–Mexico energy trade by monetizing U.S. natural gas exports through Mexico’s west coast. This enhances cross-border energy integration, creates bilateral economic value, and reinforces the role of U.S. and Mexico as strategic partners in delivering secure and affordable energy to the world.

About LNG Alliance

LNG Alliance (est. 2013), an affiliate of Texas-based Epcilon LNG LLC, is powering the future with cutting-edge gas and LNG terminal infrastructure across the USA, Mexico, Southeast Asia, and Europe. Backed by strategic partnerships with top-tier energy and technology leaders from the USA, Middle East, and Europe; LNG Alliance delivers reliable, transition and sustainable energy with global reach and local impact.

About Gunvor Group

Gunvor Group is one of the world’s leading independent commodities trading companies, with a global presence in trading, shipping, refining, and investments across energy transition projects. Gunvor is a major player in the global LNG market, with a portfolio of long-term offtake, supply, and shipping arrangements.

LIBREVILLE – Gabon National Oil Company (GOC) is pleased to announce the successful completion of the acquisition of 100% of the shares in Tullow’s subsidiary, Tullow Oil Gabon S.A, for a total cash consideration of USD 307 million of net tax and customary adjustments.

Tullow Oil Gabon S.A. holds all of Tullow’s non-operated working interests in Gabon, representing approximately 10 kbopd of 2025 expected production and approximately 36 million barrels of 2P reserves (independently audited at year-end 2024). Gunvor provided financial support to GOC for a portion of the acquisition costs.

“Gunvor is pleased to expand upon our existing partnership with GOC for this strategic acquisition,” said Tawfik Sadfi, Gunvor’s Global Head of STF & STF Business Development & Origination. “Gunvor’s global market expertise and financing capabilities complement well Gabon’s energy agenda.”

“After the acquisition of Assala Energy Holdings Limited a year ago, this new business acquisition aligns perfectly with our strategic goals as national oil company, namely to help the Gabonese State maximise its oil revenues and reinforce control over the country’s oil and gas reserves,”’ said Mr. Marcellin Simba Ngabi, GOC’s Chief Executive Officer.

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by trading volume, creating logistics solutions that safely and efficiently move physical energy from where it is sourced to where it is demanded most. With strategic investments in industrial infrastructure (refineries, pipelines, storage and terminals), Gunvor further generates sustainable value across the global supply chain for its customers. Gunvor trades in more than 100 countries with three main trading hubs in Geneva, Singapore and Houston, along with other trading offices in Stamford, Dubai, London and Shanghai, supported by a network of more than 20 representative and other trading offices around the globe.

SINGAPORE (7 July 2025) – Gunvor Singapore Pte. Ltd. (the “Borrower”), a wholly-owned subsidiary of Gunvor Group Ltd (“Gunvor” or the “Group”), has closed a US$1.285 billion sustainability-linked, syndicated revolving credit facility (“RCF” or “Facility”) on 13 June 2025.

The Facility, which was launched initially at US$800 million in April 2025, received strong support from Gunvor’s banking partners and attracted new banks, bringing together a total of 28 banks to close significantly oversubscribed by over 60% at general syndication. The Borrower has further upsized the Facility by US$50 million via an accordion feature, which was structured to accommodate two banks that joined the Facility after signing. This brings the total Facility amount to US$1.335 billion as of 7 July 2025, an increase from the previous year.

The 364-day Facility, which is guaranteed by the Company and includes two 12-month extension options, will be used for general corporate and working capital purposes, including the refinancing of the Borrower’s existing US$1.32 billion 2024 Asia Sustainability-linked Revolving Credit Facility.

Similar to previous financings, the Facility includes four sustainability Key Performance Indicators (KPIs) supporting the Group’s strong commitment to improve the environmental and social impacts of its trading operations and to invest in sustainable commodities and businesses. The KPIs relate to the reduction of Scope 1 and 2 Greenhouse Gas (GHG) emissions; reduction of Scope 3 GHG emissions associated with the improvement of energy efficiency of the chartered shipping fleets; the investment in non-hydrocarbon projects; and the assessment of the Group’s assets, JVs and critical suppliers against Human Rights principles. Each KPI is tested annually and verified externally in line with LMA Sustainability-Linked Loan Principles.

“We are very satisfied with the result of our Asian RCF renewal. This achievement is attributed to the strong relationships we maintain with our long-standing banking partners. Additionally, we are pleased to welcome several new lendersthis year”, said Jean Rohr, Gunvor’s Regional CFO for Asia-Pacific.

Abu Dhabi Commercial Bank PJSC, China CITIC Bank International Limited, DBS Bank Ltd., MUFG Bank, Ltd. and Oversea-Chinese Banking Corporation Limited were mandated to arrange the Facility and acted as the Active Bookrunning Mandated Lead Arrangers for the Facility. Agricultural Bank of China Limited, Singapore Branch, Emirates NBD Bank (P.J.S.C), Singapore Branch, First Abu Dhabi Bank PJSC, Natixis, Singapore Branch and State Bank of India, Singapore Branch remain as the Bookrunning Mandated Lead Arrangers. DBS Bank Ltd. also acted as syndication coordination agent and sustainability coordinator of the Facility, while Natixis, Singapore Branch also acted as Facility Agent, legal and documentation agent.

Bank of China Limited, Singapore Branch, China Construction Bank Corporation Singapore Branch, Coöperatieve Rabobank U.A., Singapore Branch, Crédit Agricole Corporate and Investment Bank, Singapore Branch, ING Bank N.V., Singapore Branch, Krung Thai Bank Public Company Limited, Singapore Branch, UBS AG, Singapore Restricted Branch, and Westpac Banking Corporation, Singapore Branch are Mandated Lead Arrangers.

China CITIC Bank Corporation Limited, Shanghai Branch, Mizuho Bank, Ltd., SOCIÉTÉ GÉNÉRALE, a public limited company incorporated in France, acting through its Hong Kong branch, and United Overseas Bank Limited are Lead Arrangers.

Commerzbank Aktiengesellschaft, Singapore Branch, Habib Bank Limited, Singapore Branch, National Bank of Fujairah PJSC, Sumitomo Mitsui Banking Corporation Singapore Branch, and Sumitomo Mitsui Trust Bank, Limited Singapore Branch remain as Arrangers. Furthermore, Arab Bank plc, Bank of Communications Co., Ltd., Singapore Branch and China Merchants Bank Co., Limited, Singapore Branch joined as new Arrangers.

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by trading volume, creating logistics solutions that safely and efficiently move physical energy from where it is sourced to where it is demanded most. With strategic investments in industrial infrastructure (refineries, pipelines, storage and terminals), Gunvor further generates sustainable value across the global supply chain for its customers. Gunvor trades in more than 100 countries with three main trading hubs in Geneva, Singapore and Houston, along with other trading offices in Stamford, Dubai, London and Shanghai, supported by a network of more than 20 representative and other trading offices around the globe.

Innovative Approach Focused on Delivering Impactful and Measurable Decarbonization Results

PureWest Energy, LLC (“PureWest”), a leading Rocky Mountain independent natural gas producer recognized for its low methane and carbon emission rates, and Gunvor USA LLC, a member of Gunvor Group (“Gunvor”), one of the largest independent energy commodities trading companies worldwide, are partnering to provide verified low-carbon natural gas, which can stand alone or be blended with renewable natural gas (RNG) to meet key decarbonization goals, including Scope 3 emissions reduction targets.

Under the agreement, Gunvor will offtake PureWest’s third-party verified, low-carbon natural gas attributes, which may be unbundled or bundled with physical gas. PureWest’s production is measured and independently verified in alignment with ISO 14067, the global standard for quantifying and reporting the carbon footprint of a product’s life cycle. This innovative approach provides scalable and traceable solutions to reduce carbon emissions for downstream industrial end-users and is supported by CleanConnect’s ProveZero™ registry – an auditable, blockchain-backed system built to verify environmental attributes and carbon intensity with full transparency.

“PureWest produces natural gas with one of the lowest carbon intensities in North Americaand we remain committed to providing reliable, lower carbon energy options for end-users,” said Chris Valdez, PureWest CEO. “We’re proud to partner with Gunvor to deliver independently verified, low-carbon natural gas solutions that help end-users meet their decarbonization goals.”

Gunvor will integrate PureWest’s verified low-carbon natural gas into its supply portfolio, supporting the development of a verified low-carbon blended gas product that can meet global standards, including ISCC, and will help its customers achieve emissions reduction and decarbonization ambitions while maintaining supply reliability.

“Gunvor is committed to offering energy solutions that meet growing market decarbonization needs, especially as more of our customers are seeking new avenues to reach their emissions reductions goals,” said Gary Pedersen, President and CEO of Gunvor USA LLC. “By partnering with PureWest, a leading producer of verified low-carbon natural gas, we’re bringing innovative and scalable solutions to the market, and giving our customers the option of using lower-carbon and more sustainable energy.”

PureWest’s verified low-carbon gas is supported by CleanConnect, who provides comprehensive monitoring solutions, using continuous data from CleanConnect’s autonomous monitoring systems, which detect, classify, and timestamp emissions with precision and scale far beyond traditional Leak Detection and Repair (LDAR) or quarterly methods.

This agreement is an important milestone in accelerating measured, verifiable environmental attributes with commercial-scale energy distribution. The partnership between PureWest and Gunvor also reflects unique and collaborative industry approaches to meeting critical decarbonization goals through scalable, data-driven solutions across key end-use sectors.

About PureWest

PureWest Energy, LLC is a private energy company focused on developing its long-life gas reserves in Wyoming’s Green River Basin where the Company operates more than 108,000 net acres in the prolific Pinedale Field. PureWest’s commitment to stakeholders includes exceptional safety performance, an employee led community investment program, and industry leading emissions mitigation focused on rigorous Measurement, Monitoring, Reporting and Verification (MMRV) with ISO 14067 alignment. Additional information is available at PureWest.com.

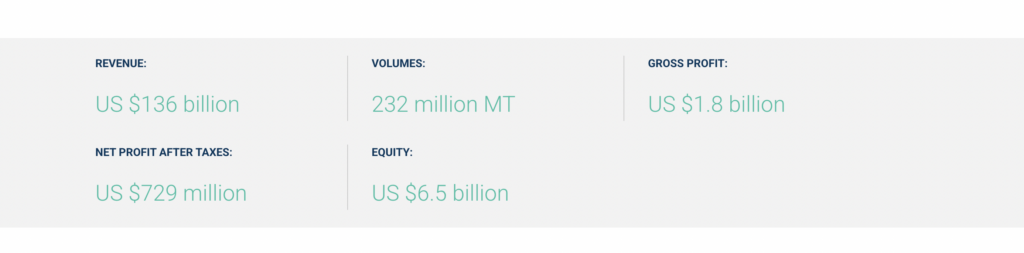

Gunvor Group Ltd (“Gunvor”), one of the world’s leading independent commodities trading companies, today announces the following financial information for the year ended 31 December 2024:

Revenue: US $136 billion

Volumes: 232 million MT

Gross profit: US $1.8 billion

Net profit after taxes: US $729 million

Equity: US $6.5 billion

Gunvor continued its track record of solid performance, posting a net income of US $729 million. The result reflects a return to more normalized energy markets compared with the previous two years, which featured significant volatility related to the global pandemic, the energy crisis, and international conflicts that had roiled energy markets.

The Group’s revenue increased to US $136 billion for the year, led by the growth of physically traded volumes of crude oil and refined products, which compensated for the lower-price commodities environment. Gunvor also continued to focus on trading Energy Transition commodities, which comprised almost 30% of total traded volumes.

While the Group’s result is lower than the highs of recent years, it remains above the pre-pandemic era and stands as the fourth-highest historically. Businesses related to the Energy Transition and shipping and chartering balanced those operating in the stabilized crude oil and refined product markets. Profits were further impacted by impairments, including for the Rotterdam refinery, whose processing units are being reviewed for mothballing.

During the year, the company formally entered or expanded into new market sectors through significant investments in: power generation in Spain; retail fuel distribution in Pakistan; upstream natural gas production in the United States; and solar development in Italy.

At year end, the Group’s equity stood at US $6.5 billion, which serves as a solid foundation for the future development of Gunvor’s trading and investment activities.

Gunvor’s shareholding at year-end stood at 84.79% held by Torbjörn Törnqvist, the majority beneficial owner, with the remaining 15.21% held by the Gunvor Employee Shareplan. There are no outside shareholders or economic interests.

Gunvor and New Energy to collaborate on industrial-scale waste tire recycling

Texas LNG, Gunvor Announce Binding LNG Offtake Agreement

Genesis Fertilizers and Gunvor Pursuing Partnership to Secure Natural Gas Supply, DEF Offtake, and Carbon Credits Monetization

AMIGO LNG Signs 20-Year LNG SPA with GUNVOR to Deliver Reliable, Competitive Energy to Global Markets

Gabon National Oil Company successfully closes Tullow Oil Gabon asset acquisition

Gunvor secures US $1.335 billion sustainability-linked syndicated RCF with oversubscription

PureWest and Gunvor Group Partner to Accelerate Use of Verified Low-Carbon Gas Solutions

Gunvor Group Results 2024

Since 2000, Gunvor has annually allocated a portion of net profit to charitable activities. The Gunvor Foundation was established to formalize the structure and direction of these philanthropic programs.