Moving Energy Efficiently

News

Home > Media>News & Statements> Gunvor and Oiltanking to Build New Indonesian Terminal

Gunvor and Oiltanking to Build New Indonesian Terminal

12 June 2013

Moving Energy Efficiently

Home > Media>News & Statements> Gunvor and Oiltanking to Build New Indonesian Terminal

12 June 2013

Oil products**Oil Products** Oil products, also known as petroleum products, are the end products derived from the processing of crude oil in oil refineries. Crude oil is a fossil fuel that... Read more terminal in Karimun will meet continuing Asian demand growth

Gunvor Group together with Oiltanking GmbH announce the construction of a greenfield terminal, Oiltanking Karimun, on the island of Karimun, Indonesia. The facility, which will have an initial petroleum storage capacity of 760,000 cbm, will meet the incremental petroleum storage needs of Greater Singapore. Oiltanking Karimun will be managed and operated by Oiltanking as an independent commercial storage facility. Gunvor will take a minority equity stake and rent part of the capacity. The deal comes as a part of Gunvor’s investment and Asian growth strategy.

As an alternative to tightening petroleum storage in Singapore, the island of Karimun has been selected due to its proximity to Jurong Island, Singapore’s industrial petroleum and petrochemicalPetrochemical refers to a substance that is obtained by refining and/or processing petroleum or natural gas. Read more hub, and existing ship-to-ship operations off the coast. Karimun further offers favorable nautical conditions, such as easy access to VLCC size vessels, and availability of ready-to-build land.

While Singapore’s storage capacity has been growing steadily over the last decade, further growth is hampered by the scarcity of waterfront and lack of land available for new expansions.

The terminal, which is expected to be operational by second quarter 2015, will cater to the storage and handling of both light and black oil products. The initial capacity will be supported by four jetties capable of accommodating vessels of up to VLCC dimensions. The terminal has ample land for further expansion.

About Oiltanking GmbH

Oiltanking GmbH is a subsidiary of Marquard & Bahls AG, Germany, a leading petroleum company, privately owned. Oiltanking is the second largest independent tank storage provider for petroleum products, chemicals and gases worldwide. The company owns and operates 75 terminals in 23 countries within Europe, North and South America, Middle East, India as well as Asia. Oiltanking has an overall capacity of 20.3 million cubic meters. For further information please visit www.oiltanking.com.

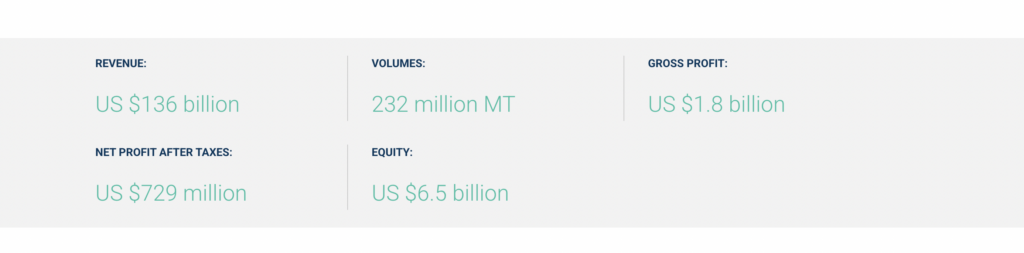

Gunvor Group Ltd (“Gunvor”), one of the world’s leading independent commodities trading companies, today announces the following financial information for the year ended 31 December 2024:

Revenue: US $136 billion

Volumes: 232 million MT

Gross profit: US $1.8 billion

Net profit after taxes: US $729 million

Equity: US $6.5 billion

Gunvor continued its track record of solid performance, posting a net income of US $729 million. The result reflects a return to more normalized energy markets compared with the previous two years, which featured significant volatility related to the global pandemic, the energy crisis, and international conflicts that had roiled energy markets.

The Group’s revenue increased to US $136 billion for the year, led by the growth of physically traded volumes of crude oil and refined products, which compensated for the lower-price commodities environment. Gunvor also continued to focus on trading Energy Transition commodities, which comprised almost 30% of total traded volumes.

While the Group’s result is lower than the highs of recent years, it remains above the pre-pandemic era and stands as the fourth-highest historically. Businesses related to the Energy Transition and shipping and chartering balanced those operating in the stabilized crude oil and refined product markets. Profits were further impacted by impairments, including for the Rotterdam refinery, whose processing units are being reviewed for mothballing.

During the year, the company formally entered or expanded into new market sectors through significant investments in: power generation in Spain; retail fuel distribution in Pakistan; upstream natural gas production in the United States; and solar development in Italy.

At year end, the Group’s equity stood at US $6.5 billion, which serves as a solid foundation for the future development of Gunvor’s trading and investment activities.

Gunvor’s shareholding at year-end stood at 84.79% held by Torbjörn Törnqvist, the majority beneficial owner, with the remaining 15.21% held by the Gunvor Employee Shareplan. There are no outside shareholders or economic interests.

Brisbane, Australia - Akaysha Energy, a market leader in large-scale battery energy storage systems (BESS), and Gunvor Group a global energy powerhouse, are pleased to announce a long term Offtake Agreement for Akaysha’s large scale Battery Energy Storage System (BESS), in Brendale, Queensland.

The risk-hedging offtake product, known as a Battery Revenue Swap Agreement, provides revenue certainty for the Brendale BESS while allowing Akaysha Energy to optimise operations and respond to market signals. Currently under construction, the project is scheduled to commence operations by early-to-mid 2026. The parties have also agreed to investigate similar arrangements for Akaysha’s Japanese Battery storage projects.

Located in Brisbane’s outer Northern suburbs, the Brendale BESS will have a capacity of 205 MW / 410 MWh, making it capable of charging from excess solar generation and storing enough energy to power up to 200,000 homes for up to 2 hours. The project’s Grid Forming capability will increase the robustness of the network voltage in the nearby major Queensland transmission infrastructure.

Market Innovation & Economic Viability

For Akaysha, the Offtake Agreement demonstrates its position as a market leader in securing innovative offtake agreements. This is the third Over-the-Counter (OTC) contract across its portfolio, with these bilateral offtake contracts providing better alignment and outcomes for both parties.

This Offtake Agreement follows the A$650 million debt financing Akaysha secured from a domestic and global syndicate of eleven banks to fund the construction of its 1,660MWh Orana BESS, complemented by a 12-year, 200 MW virtual toll offtake agreement with EnergyAustralia. And in July 2023, Akaysha completed what was the first Battery Revenue Swap Agreement of its kind at the time, with Re2 Capital, for its 150MW Ulinda Park BESS, in Queensland’s Western Downs.

With this Offtake Agreement in place, Akaysha’s total contracted capacity across its portfolio of four assets in construction now exceeds 1.6 gigawatts.

Importantly, the Offtake Agreement demonstrates the economic viability of large-scale batteries and that they can deliver appropriate returns through wholesale market pricing, which will further accelerate the deployment of energy storage infrastructure.

Paul Curnow, Managing Director and Chief Commercial Officer at Akaysha Energy, commented:

“This offtake with Gunvor highlights the growing sophistication of financial products Akaysha is developing with its partners to support Australia’s evolving energy landscape. The partnership ensures revenue certainty for Brendale BESS while preserving the flexibility needed to adapt to market dynamics. It’s an essential step in advancing large-scale battery projects like ours, which are critical for strengthening grid stability, ensuring long-term reliability, and supporting the transition as coal-fired power stations retire.”

With significant retirement of Queensland’s coal generation over the next decade (source), large-scale BESS projects like Brendale will play a pivotal role in enhancing grid stability and ensuring the grid remains resilient during this transition, particularly in managing unforeseen coal generator outages as they retire and addressing renewable intermittency.

Commenting on how the Agreement points to the growing opportunity of the Australian energy market and the role global partners can play supporting the transition to a more sustainable energy future, David Maher, Head of APAC Power Trading & Origination, added:

“This partnership will be an important part of Gunvor’s APAC strategy as we expand our involvement in the energy transition and provide risk management services. This landmark Agreement reflects the growing role of batteries in delivering much needed flexible and reliable energy solutions. We look forward to furthering our commitment to innovative, sustainable energy solutions.”

Energy Trading Capabilities

Akaysha’s expanding portfolio is backed by a growing energy trading team, leveraging advanced strategies to navigate Australia’s fast-paced NEM (National Electricity Market), where prices fluctuate every five minutes. Using cutting-edge tools like algorithmic auto-bidding, the team optimises asset performance and maximises market participation.

About Akaysha Energy

Akaysha Energy is one of the largest BESS build, own, operators in Australia, with a pipeline of projects in the US and Japan. Established in Australia in 2021 as an Independent Power Producer (IPP), Akaysha has now grown to more than 140 people – with offices in Melbourne, Sydney, Brisbane, Singapore, Tokyo, Portland and Houston.

Supported by over A$3 billion in capital from global institutional investors, including BlackRock, Akaysha Energy currently has a 4GWh portfolio of four mega-scale BESS projects under construction, with an additional 20GWh in development across Australia. Akaysha Energy’s Waratah Super Battery (850MW/1680MWh) is the world’s most powerful battery and the largest single connection point in the NEM.

Akaysha Energy combines market-leading expertise in energy and capital markets, project development, revenue contracting, operations and trading. This deep in-house capability maximises value across all stages of the BESS lifecycle. For more information, visit akayshaenergy.com

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy, bulk materials, and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. For more information, visit GunvorGroup.com

LAHORE (6 December 2024) – Gunvor Group, a leading global commodities trading company, has completed its acquisition of TotalEnergies’ 50% stake in Total PARCO Pakistan Limited (TPPL), after receiving all necessary approvals from relevant authorities and finalizing related agreements.

TPPL operated as a 50/50 joint venture between TotalEnergies Marketing and Services and Pak-Arab Refinery Limited (PARCO) in Pakistan, with a retail network of more than 800 service stations, fuel logistics, and lubricants activities.

The new entity will continue to serve its customers through its retail business under the existing “Total PARCO” brand, and its lubricants business under the “Total” brand in Pakistan.

“This acquisition represents a significant investment in the retail and distribution space, and contributes to Gunvor’s strategy of owning and investing in assets along the value chain that support our core trading operations,” said Shahb Richyal, Gunvor’s Global Head of Portfolio.

About Gunvor

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy, bulk materials, and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. For more information, visit GunvorGroup.com

About Pak-Arab Refinery Limited (PARCO)

PARCO is a fully integrated energy company and is one of the largest companies in Pakistan’s corporate sector. A Joint Venture between the Government of Pakistan (60%) and the Emirate of Abu Dhabi (40%), PARCO is a leading energy company incorporated as a public limited company in 1974 through its Mubadala Investment Company. With its modern refinery, an extensive pipeline network, storage of over 1.5 million tons at various locations and marketing activities, PARCO is fueling Pakistan’s economic growth.

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas and green gases, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

GENEVA – Gunvor Group Ltd (“Gunvor” or the “Group”) has signed a US $2.265 billion sustainability-linked, multi-currency revolving credit facility (“RCF” or “Facility”) in favour of Gunvor International B.V. and Gunvor SA.

The Facility consists of two tranches, available to Gunvor International B.V. and Gunvor SA:

Thanks to strong support from existing and new banking partners, the Facility ended up substantially upsized versus last year. Additional liquidity was successfully raised in both tranches.

The RCF will be used for general corporate purposes, including the refinancing of the existing US $1,535,000,000 364-day tranche of the 2023 European Revolving Credit Facilities Agreement, and the US $280,000,000 3-year tranche of the 2022 European Revolving Credit Facilities Agreement.

The Facility has a US $400 million Accordion Option and complements the existing US $350 million 3-year tranche of the 2023 European Revolving Credit Facilities Agreement.

The Facility continues to come with a comprehensive set of ESG-linked KPIs: reduction of Scope 1 and 2 Greenhouse Gas (GHG) emissions; reduction of Scope 3 GHG emissions to improve the energy efficiency of the shipping fleet; the investment in non-fossil fuel projects; and the assessment of the Group’s assets, JVs, and suppliers against Human Rights principles. Each KPI is annually tested and externally verified.

"We are pleased to see growing support from our financing partners and to onboard new lenders in the Group’s flagship facility. The increase in commitments demonstrates the strong relationship the Company has with its banking group and its support of our growth strategy,” said Jeff Webster, Chief Financial Officer of Gunvor Group.

Arab Petroleum Investments Corporation (APICORP), Coöperatieve Rabobank U.A., Crédit Agricole Corporate and Investment Bank, Emirates NBD Bank (P.J.S.C), London Branch, ING Bank N.V., Amsterdam, Lancy / Geneva Branch, Mizuho Bank, Ltd., Natixis CIB, Qatar National Bank (Q.P.S.C.) Paris Branch, SMBC Bank International plc, Société Générale, UBS Switzerland AG and UniCredit Bank GmbH (together the “Bookrunning Mandated Lead Arrangers”) were mandated to arrange the Facility. Coöperatieve Rabobank U.A., Credit Agricole Corporate & Investment Bank, ING Bank N.V., Natixis CIB, SMBC Bank International plc, Société Générale and UniCredit Bank GmbH acted as Active Bookrunners while UBS Switzerland AG is Facility and Swingline Agent. Credit Agricole Corporate & Investment Bank and SMBC Bank International plc acted as Joint Sustainability Coordinators of the Facility.

First Abu Dhabi Bank PJSC joined as new Senior Mandated Lead Arranger.

Citibank N.A., Jersey Branch, Erste Group Bank AG and KfW IPEX-Bank GmbH are Mandated Lead Arrangers.

Banco BPM S.p.A, Bank of China Limited London Branch, China Construction Bank Corporation, Beijing, Swiss Branch Zurich, DBS Bank Ltd., London Branch, DZ Bank AG Deutsche Zentral-Genossenschaftsbank, Frankfurt am Main, Industrial and Commercial Bank of China Limited, London Branch, OTP Bank plc. and Sumitomo Mitsui Trust Bank, Limited (London Branch) are Lead Arrangers. National Bank of Ras Al-Khaimah and Nedbank joined as new Lead Arrangers.

ABC International Bank Plc, AfrAsia Bank Limited, Arab Bank (Switzerland) Ltd, Banque de Commerce et de Placements SA, CaixaBank S.A., China CITIC Bank Corporation Limited, London Branch, Commerzbank AG, London Branch, Europe Arab Bank SA, First Commercial Bank London Branch, GarantiBank International N.V, Habib Bank AG Zurich, Mashreqbank psc, Raiffeisen Bank International AG and Union de Banques Arabes et Francaises – UBAF are Arrangers. Lloyds Bank plc joined as new Arranger.

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover creating logistics solutions that safely and efficiently move physical energy, bulk materials and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023. The Group’s main trading offices are in Geneva, Singapore, Houston, Stamford, Calgary, London, Shanghai and Dubai, supported by a network of more than 20 representative and other trading offices around the globe. For more information, visit www.gunvorgroup.com

GENEVA – Gunvor Group, one of the largest independent energy commodities trading companies worldwide, has successfully closed its inaugural United States (US) Private Placement, totalling US $378.5 million of senior unsecured notes with US institutional investors placed under Section 4(a)(2) of the Securities Act.

The transaction was significantly oversubscribed from the launch amount of US $100 million, and comprises tenors of 3, 5, 7, 10 and 12 years, with almost half of the notes placed into the 10-year and the 12-year tranches.

"As Gunvor continues to grow its business off the back of two record years of performance, we’ve worked diligently to diversify our investor base and lengthen our debt profile,” said Jeff Webster, Gunvor Group CFO. "This transaction is an important milestone that reflects the trust we have built with a new set of institutional investors while opening up a new market for Gunvor that will help accelerate our long-term growth strategy."

Funds from the transaction will support ongoing investment and trading activities as the company continues to grow its global platform.

"We are pleased to have had the opportunity to represent Gunvor in this debut USPP and achieve one of the largest issue sizes and longest maturities by an independent commodity trader in this market," said Duncan Scott, Head of US Private Placements at Societe Generale.

Michael Haddad, Director for Private Placements at MUFG added: "MUFG is proud to have acted as Placement Agent on this very successful debut private placement for Gunvor. Gunvor’s Private Placement impressed in terms of size, tenor, flexibility, and quality of investors – a true testament to the strength of the Private Placement market and the Gunvor credit."

Societe Generale and MUFG acted as Joint Placement Agents for the transaction.

About Gunvor Group

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover creating logistics solutions that safely and efficiently move physical energy, bulk materials and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. The Group’s main trading offices are in Geneva, Singapore, Houston, Stamford, Calgary, London, Shanghai and Dubai, supported by a network of more than 20 representative and other trading offices around the globe. For more information, visit www.gunvorgroup.com.

HOUSTON – Gunvor USA LLC, an indirect wholly-owned subsidiary of Gunvor Group Ltd, has successfully closed the syndication of its US $2.34 billion uncommitted borrowing base credit facility. The facility, which benefited from strong oversubscription, includes a US $1.75 billion one-year tranche and a US $584 million two-year tranche, as well as a US $500 million accordion feature to support future growth.

The proceeds of the facility will refinance Gunvor USA’s existing US $1.94 billion borrowing base facility, which was initially launched in October 2023 and later increased through an accordion feature in May 2024. The purpose of the upsized facility is to provide continued working capital financing for the company’s merchant activities and fund general corporate purposes.

“Gunvor USA’s successful capital raise reflects the continued confidence of our banking partners in the U.S. business and Gunvor Group globally,” said David Garza, managing director of Gunvor USA. “Our business model has proven to be resilient during times of market stress. That success, combined with bank market support, affords us the ability to focus on strategic growth opportunities across North America.”

Thomas Smith, regional CFO for the Americas, commented: “We take pride in strong global collaboration across Gunvor. Our 21 financing partners—including four new lenders this year—have shown robust support for our company’s strategy and positive outlook.”

The facility is led by Rabobank, which serves as administrative agent, mandated lead arranger, active bookrunner, coordinator and left lead. Societe Generale, ING Capital and MUFG Bank also acted as mandated lead arrangers, the foremost holding responsibility as active bookrunner, while the latter both contribute as passive bookrunners.

Citibank N.A., Credit Agricole Corporate and Investment Bank, Natixis, New York Branch, and Sumitomo Mitsui Banking Corporation each serve as joint lead arrangers and share co-syndication agent duties.

Bank of China, New York Branch and First Abu Dhabi Bank USA N.V. join the facility as new co-documentation agents together with Deutsche Bank AG New York Branch, Industrial and Commercial Bank of China Limited, New York Branch, Mizuho Bank Ltd. and UBS Switzerland AG all acting in the same capacity.

Zukerman Gore Brandeis & Crossman, LLP serves as counsel to the administrative agent. McGuireWoods LLP serves as counsel to the borrower.

About Gunvor Group

Gunvor Group Ltd is one of the world’s largest independent commodities trading houses by turnover creating logistics solutions that safely and efficiently move physical energy, bulk materials and base metals from where they are sourced and stored to where they are demanded most. Gunvor Group, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. The Group’s main trading offices are in Geneva, Singapore, Houston, Stamford, Calgary, London, Shanghai and Dubai, supported by a network of more than 20 representative and other trading offices around the globe. For more information, visit www.gunvorgroup.com.

BILBAO – Gunvor Group (“Gunvor”), a leading global independent energy trading company, has completed the acquisition of a 75% ownership stake in Bahía De Bizkaia Electricidad S.L. (“BBE”), a 785MW combined cycle power plant located in Bilbao, Spain from bp.

The deal, announced in December 2023, has been approved by all relevant regulatory bodies, including the European Union (EU) Commission’s review of Merger Control (EUMR) and Foreign Subsidies Regulation (FSR).

Ente Vasco de la Energía (“EVE”), the energy agency of Basque Country, holds the remaining 25% ownership stake in BBE.

BBE is Gunvor’s first investment in a power generation asset, while expanding the company’s commitment to developing Spain’s energy sector. Gunvor’s strength in natural gas/LNG and growing power business will complement operations at the plant and contribute positively to Spain’s economy over the long-term.

About Gunvor

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy, bulk materials, and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. For more information, visit GunvorGroup.com

FUJAIRAH – Gunvor Group Co-founder and Chairman, Torbjörn Törnqvist, has been honored with the Aramco Trading "New Silk Road CEO of the Year Award" 2024, given on the occasion of the 12th Fujairah Energy Markets Forum.

Held under the patronnage of His Highness Sheikh Hamad Bin Mohammed Al Sharqi, Supreme Council Member and Ruler of Fujairah, and in the presence of H.H. Sheikh Dr. Rashid bin Hamad Al-Sharqi, Deputy Chairman of the Fujairah Oil Industry Zone, the awards recognized leaders reshaping energy markets along the Middle East-Asia corridor.

Dave Ernsberger, Head of Market Reporting & Trading Solutions at S&P Global Commodity Insights, announced the award:

"Torbjörn has always been guided by a clear personal philosophy and set of values, including hard work, operating with integrity, and innovation."

Your Highness, Excellencies, Distinguished guests and Ladies and Gentlemen, Good Evening.

It is my pleasure to introduce the winner of the 2024 Aramco Trading New Silk Road CEO of the Year in the category of Trading – Torbjörn Törnqvist, Chairman, Gunvor Group.

Torbjörn has had an extraordinary career spanning more than 40 years in the oil and gas industry. He co-founded Gunvor Group in 2000, and under his leadership the company has grown into one of the world’s leading independent commodities trading companies, with operations in over 100 countries. Gunvor’s business now extends beyond oil trading to include a diverse range of commodities such as natural gas, agriculture, and metals.

Born in Stockholm, Torbjörn began his career at British Petroleum in 1977, where he worked for six years before moving on to become the Head of Oil Trading at Scandinavian Trading Co AB. His deep understanding of the oil markets proved invaluable when he went on to serve as Managing Director for the oil division of Intermaritime Group Petrotrade. That experience prepared him to take the bold step of co-founding Gunvor with Gennady Timchenko in 2000.

Gunvor initially focused on trading Russian crude oil to Europe, where it quickly gained a reputation for its ability to navigate the complexities of the Russian oil industry. Torbjörn is known not only for his strong leadership but also for his hands-on management style. He is actively involved in the day-to-day operations of the company and is widely respected for his meticulous attention to detail.

His leadership is defined by leading by example. He encourages his employees to take ownership of their work, and his ability to identify and nurture talent within the company has been central to Gunvor’s success.

Torbjörn’s has also been quick to adapt to changing circumstances, critical in the commodity markets, and this has ensured that Gunvor has remained competitive in a fast-evolving global market.

Torbjörn has always been guided by a clear personal philosophy and set of values, including hard work, operating with integrity, and innovation. Throughout his career, he has remained committed to conducting business in an ethical and transparent manner, and I’ve seen this myself in many of the meetings between Platts and Gunvor over the years, including times when we agreed on a point of discussion, and on times when we’ve disagreed. His dedication to operating with integrity has earned him the respect of his peers and has helped to build trust with Gunvor’s partners and customers.

Torbjörn is a strong advocate of innovation, embracing new ideas and technologies, and taking risks to explore new approaches.

...

Overall, Torbjörn’s leadership and management style have been instrumental in the success of Gunvor. His focus on results, sense of a wider mission and ability to adapt to changing circumstances have helped the company grow and thrive in a highly competitive industry.

All that remains for me to say is that Torbjörn is a very deserving recipient of this year’s Award in the “Category of Trading” – Congratulations!

LAHORE – Gunvor Group, a leading global commodities trading company, has signed an agreement to purchase TotalEnergies’ 50% stake in Total PARCO Pakistan Limited (TPPL).

TPPL is a 50/50 joint venture between TotalEnergies Marketing and Services and Pak-Arab Refinery Limited (PARCO) in Pakistan with a retail network of more than 800 service stations, fuel logistics, and lubricants activities.

The new entity will continue its retail business under the existing “Total Parco” brand, and its lubricants business under the “Total” brand in Pakistan, continuing to serve its customers.

The acquisition remains subject to authorization by the relevant authorities and related agreements.

About Gunvor

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy, bulk materials, and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. For more information, visit GunvorGroup.com

About TotalEnergies

TotalEnergies is a global integrated energy company that produces and markets energies: oil and biofuels, natural gas and green gases, renewables and electricity. Our more than 100,000 employees are committed to provide as many people as possible with energy that is more reliable, more affordable and more sustainable. Active in about 120 countries, TotalEnergies places sustainability at the heart of its strategy, its projects and its operations.

ZUG / GENEVA – Gunvor Group (“Gunvor”) will join VARO Energy (“VARO”) in building a large-scale SAF manufacturing facility at the Gunvor Energy Rotterdam site through a proposed joint venture.

Since VARO announced on September 7, 2023 its intention to build a large scale SAF facility as a sole owner with total feedstock capacity of 350 kt pa., the project has made good progress.

Under the terms of the agreement, costs, and risks to develop the plant up to the final investment decision (FID) will be shared on an equal basis. Upon joint FID, and subject to necessary regulatory approvals, VARO and Gunvor will form a project company owned equally by both parties.

Following a rigorous project development process, the basis of design has been finalised and the Front-End Engineering Design (FEED) phase is expected to be completed in Q4 2024.

The facility is being designed to be able to process a variety of feedstocks. It will also have the capability to produce either SAF or HVO end products, allowing VARO and Gunvor to capture potential value by switching based on market conditions and regulatory requirements.

The location of the future facility, on the brownfield location of the Gunvor Energy Rotterdam site, will see it benefit from extensive existing infrastructure. This includes the transportation and relevant pipeline network, existing utilities and port facilities and geographic proximity to key customers and markets in Northern Europe and beyond.

Aviation is a vital and growing part of the global economy, connecting people and businesses around the world. However, it is also one of the fastest-growing sources of greenhouse gas emissions. Through this investment, VARO and Gunvor will support the aviation sector's decarbonisation with the capacity to produce SAF equivalent to 7% of the current SAF mandate set by the European Union for 2030.

Torbjörn Törnqvist, CEO of Gunvor, said:

“Large scale production and adoption of SAF are critical to meeting the airline industry’s goal of achieving net-zero emissions by 2050. We look forward to working with VARO to develop SAF production at our site in Rotterdam, which is a strategically central location with proximity to extensive port facilities, major European airports, and well-developed energy infrastructure.”

Dev Sanyal, CEO of VARO Energy, said:

“If efforts to decarbonise aviation are to be successful, it is essential that European SAF supply increases to meet mandated demand growth by the end of the decade. This can only be achieved by designing and constructing production facilities leveraging existing infrastructure coupled with the ability to process the widest range of feedstocks and the flexibility to produce both HVO and SAF. At VARO, we have developed this project with a focus on cost competitiveness in order to be a reliable counterparty for our customers’ growing demand.

Strong partnerships between companies will accelerate this pathway and I am delighted that Gunvor will be joining us as an equal partner. Our focus now is on completing FEED this year in order to move towards a Final Investment Decision.”

Notes to editors

About SAF

Sustainable Aviation Fuel is a ‘drop-in’ fuel. It is compatible with existing aircraft and fuel logistics infrastructure without requiring any modifications. At scale, SAF has an important role to play in helping the aviation industry decarbonise. Used as a direct replacement for conventional aviation fuel, SAF offers up to 90% Greenhouse Gas (“GHG”) savings, allowing the commercial aviation sector to decarbonise the vast majority of its emissions.

About VARO Energy

VARO Energy (“VARO”) is the partner of choice for customers in the energy transition by providing the sustainable and reliable energy solutions that they need to decarbonise. Engine 1 includes manufacturing, storage, distribution, marketing, and trading of conventional energies. Engine 2 activities are focused on sustainable energies and include biofuels, biogas, green hydrogen, e-mobility, and nature-based carbon removals. VARO plans to invest around $3.5 billion over the 2022-26 period, with two-third committed to sustainable energies. The company has a net zero target for scope 1, 2 and 3 by 2040. VARO, a private company owned by Carlyle Group (66.66%) and Vitol (33.33%) is headquartered in Switzerland with a diversified presence in twenty-six countries.

About Gunvor

Gunvor Group is one of the world’s largest independent commodities trading houses by turnover, creating logistics solutions that safely and efficiently move physical energy, bulk materials, and base metals from where they are sourced and stored to where they are demanded most. Gunvor, which generated turnover of US $127 billion on volumes of 177 million MT in 2023, has committed to cut Scope 1 and 2 emissions by 40% by 2025. For more information, visit GunvorGroup.com

Have a suggestion to improve this definition?