SINGAPORE – Gunvor Singapore Pte. Ltd. (the “Borrower”), a wholly-owned subsidiary of Gunvor Group Ltd (“Gunvor” or the “Group”), has closed a US $1.2 billion sustainability-linked, syndicated revolving credit facility (“RCF” or “Facility”) on 14 June 2024.

The Facility, which was launched initially at US $750 million in April 2024, benefited from strong support from Gunvor’s banking partners and attracted new banks, and closed significantly oversubscribed by over 60%, increasing the total facility amount from the previous year. The Borrower has further upsized the Facility by US $120 million via an accordion feature, which was structured to accommodate two banks that joined the Facility after signing, bringing the total Facility amount to US$1.32 billion as of 12 July 2024.

The 364-day Facility, which is guaranteed by the Company and includes two 12-month extension options, will be used for general corporate and working capital purposes, including the refinancing of the Borrower’s existing US$ 1.035 billion 2023 Asia Sustainability-linked Revolving Credit Facility.

Similar to previous financings, the Facility includes four sustainability Key Performance Indicators (KPIs) supporting the Group’s strong commitment to improve the environmental impact of its trading operations and to invest in sustainable commodities and businesses. The KPIs relate to the reduction of Scope 1 and 2 Greenhouse Gas (GHG) emissions; reduction of Scope 3 GHG emissions associated with the improvement of energy efficiency of the shipping fleet; the investment in non-fossil fuel projects; and the assessment of the Group’s assets, JVs and suppliers against Human Rights principles. Each KPI is tested annually and verified externally in line with LMA SLL principles.

“The successful renewal of our Asian RCF is the result of the deep collaboration between Gunvor and its banking partners. The strong relationship we have with our core financing partners, enhanced by the welcome addition of several new lenders into our upsized anchor facility, demonstrates their support for the Group’s strong performance and positive outlook,” said Jean Rohr, Gunvor’s Regional CFO for Asia-Pacific.

Abu Dhabi Commercial Bank PJSC, China CITIC Bank International Limited, DBS Bank Ltd., MUFG Bank, Ltd. and Oversea-Chinese Banking Corporation Limited were mandated to arrange the Facility and acted as the Active Bookrunning Mandated Lead Arrangers for the Facility. Agricultural Bank of China Limited, Singapore Branch, Arab Petroleum Investments Corporation, Emirates NBD Bank (P.J.S.C), Singapore Branch, First Abu Dhabi Bank PJSC – Singapore Branch, Natixis, Singapore Branch and State Bank of India, Singapore Branch remain as the Bookrunning Mandated Lead Arrangers. Indian Bank and Union Bank of India, DIFC Branch, Dubai joined as new Bookrunning Mandated Lead Arrangers. DBS Bank Ltd. also acted as syndication coordination agent, while Natixis, Singapore Branch also acted as Facility Agent, legal and documentation agent and sustainability coordinator of the Facility.

Coöperatieve Rabobank U.A., Singapore Branch, UBS AG, Crédit Agricole Corporate and Investment Bank, Singapore Branch, and ING Bank N.V., Singapore Branch are Senior Mandated Lead Arrangers.

China CITIC Bank Corporation Limited, Shanghai Branch joined as a new Mandated Lead Arranger, while Mizuho Bank, Ltd, Société Générale, a public limited company incorporated in France, acting through its Hong Kong branch, and United Overseas Bank Limited are Mandated Lead Arrangers.

Furthermore, Westpac Banking Corporation, Singapore Branch, Bank of China Limited, Singapore Branch and China Construction Bank Corporation Singapore Branch all joined as new Lead Arrangers, whereas Commerzbank Aktiengesellschaft, Singapore Branch, Habib Bank Limited, Singapore Branch, Krung Thai Bank Public Company Limited, Singapore Branch, and Sumitomo Mitsui Banking Corporation Singapore Branch are the Lead Arrangers.

Sumitomo Mitsui Trust Bank, Limited Singapore Branch, Banque Internationale de Commerce – BRED (Suisse) SA, and National Bank of Fujairah PJSC remain as Arrangers.

About Gunvor Group

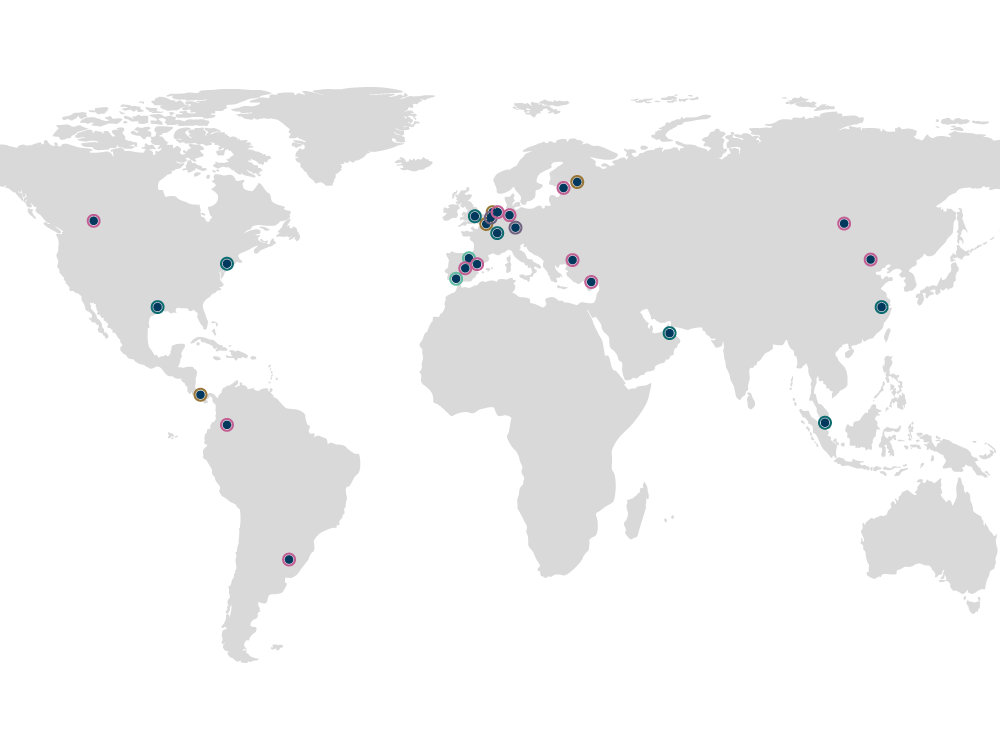

Gunvor Group is one of the world’s largest independent commodities trading houses by trading volume, creating logistics solutions that safely and efficiently move physical energy from where it is sourced to where it is demanded most. With strategic investments in industrial infrastructure (refineries, pipelines, storage and terminals), Gunvor further generates sustainable value across the global supply chain**Supply Chain** A supply chain is a complex network that includes individuals, organizations, resources, activities, and technologies involved in the production and delivery of a product or service from the... Read more for its customers. The Group’s 3 main trading hubs are in Geneva, Singapore and Houston, with other trading offices in Stamford, Dubai, London and Shanghai, supported by a network of more than 20 representative and other trading offices around the globe.